We help homeowners, investors, and business owners secure smart financing with clarity, honesty, and personal service.

Two Generations. One Goal. Getting You the Right Loan.

No two borrowers are the same, and neither are their financial goals. That’s why we take the time to understand your situation before recommending a loan. Whether you’re purchasing a home, refinancing, or financing a commercial property, we build a mortgage strategy that fits your needs today and supports your long-term plans. As a father and son brokerage, we combine proven experience with a hands-on, personal approach you won’t find at big banks.

ask us anything!

Got questions? We're here to help! Whether it's about mortgage rates, plans, or the process, feel free to ask us anything. We're ready to guide you every step of the way!

630-880-8977

[email protected]

get quotes

Get Your Personalized Mortgage Quote Today!

Smart Mortgage Solutions for Homes and Businesses.

Rudy Rodriguez Sr & Rudy Rodriguez Jr

Who we are?

Your Trusted Partner in Home & Commercial Financing

We are a father and son mortgage brokerage dedicated to helping individuals, families, and business owners secure the right financing with confidence. With experience in both residential and commercial lending, we take a hands-on approach to every loan, guiding our clients through the process with transparency, clear communication, and honest advice. Our goal is simple: to build long-term relationships by putting your needs first.

why choose us?

Building Foundations for a

Brighter Future

Home/Commercial Purchase

Refinance

Loan Options

Client Satisfaction

Personalized Solutions

Exceptional Customer Service

Your Financing Journey Starts Here.

Whether you’re purchasing a home, refinancing, or financing a commercial property, we provide the guidance and support you need to move forward with confidence. Our father and son brokerage takes a personalized approach to every loan, helping you understand your options and choose a solution that aligns with your goals today and in the future.

Personalized mortgage solutions tailored to your needs.

Expert guidance throughout the entire buying process.

Competitive rates to help you save on your investment.

what we offer ?

Tailored Residential and Commercial Mortgage Solutions

Residential Mortgages

We help homebuyers and homeowners secure loans that fit their unique goals. Whether it’s your first home, a refinance, or a jumbo property, we guide you every step of the way.

Fast Approval: Get funds quickly to secure your new home.

FHA, Conventional, VA, and Jumbo Loans

First-Time Homebuyer Programs

Refinancing & Cash-Out Options

Commercial Loans

From office buildings to rental properties, we provide tailored financing for investors and business owners. We help simplify complex commercial lending so you can focus on your investment.

DSCR Loans & Investment Property Financing

Multifamily & Mixed-Use Properties

Fix & Flip / Rental Portfolio Loans

Self-Employed Borrowers

Being your own boss shouldn’t make getting a mortgage harder. We offer programs designed for self-employed clients, including:

Bank Statement Loans – Verify income using your bank statements.

P&L Loans – Use your business’s profit and loss statements to qualify.

Stated Income / No Income Verification Loans - Allows borrowers to state income without full documentation

Refinance & Cash-Out Loans

Whether you want to lower your monthly payments, access equity, or invest in new opportunities, refinancing can help you reach your goals. We guide homeowners and self-employed borrowers through the process, explaining your options and finding a solution that fits your financial picture.

Refinance – Lower your interest rate or adjust your loan term for more manageable payments.

Cash-Out – Tap into your home’s equity for renovations, investments, or other financial goals.

Debt Consolidation – Use your equity to simplify or pay down higher-interest debt.

Construction & Renovation Loans

Planning a construction project or home renovation? We help clients secure financing that fits the project timeline and budget. From new builds to major remodels, we guide you through every step.

Construction-to-Permanent Loans – Finance the build and convert to a permanent mortgage.

Renovation / Rehab Loans – Fix up your property with flexible funding options.

Guidance from start to finish – We handle the paperwork and lender communication.

Jumbo & High-Value Loans

Buying a high-value property doesn’t have to be complicated. We provide jumbo loan options with competitive rates and personalized guidance to help you get the financing you need.

Jumbo Home Loans – For homes above conforming limits.

High-Value Commercial Loans – Office, retail, or mixed-use properties.

Customized strategies – Tailored advice for complex financial situations.

how it works

Partnering in Your Residential & Commercial Success

Consultation

We review your goals and explore the best mortgage options for you.

Application

Fill out a quick application to get the process started.

Closing

Close your loan and get ready to move forward with confidence.

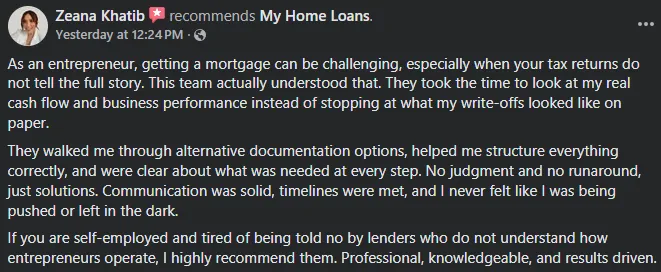

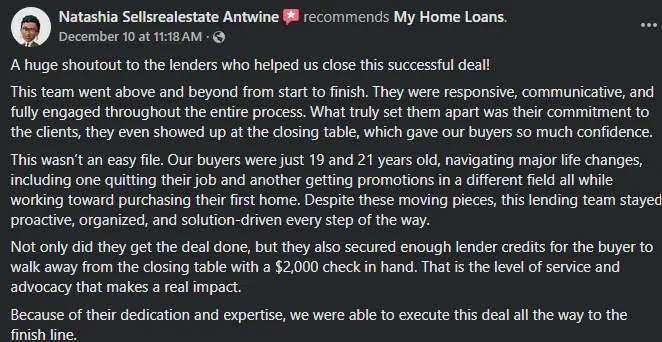

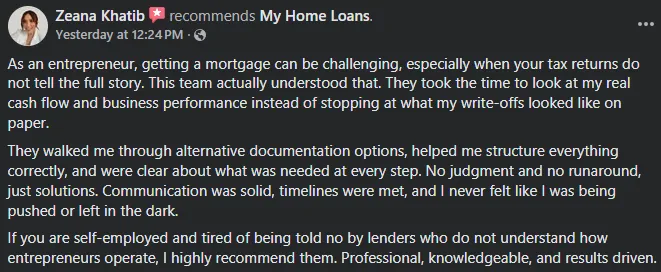

Testimonials

Frequently Asked Questions

What is the difference between a fixed-rate and an adjustable-rate mortgage?

A fixed-rate mortgage has a constant interest rate throughout the loan term, while an adjustable-rate mortgage (ARM) has an interest rate that may change periodically based on market conditions.

How do I know how much I can borrow?

Your borrowing capacity depends on various factors, including your income, credit score, debt-to-income ratio, and the type of loan you are applying for. Our team can help you assess your financial situation to determine the right amount.

What documents do I need to apply for a mortgage?

Typically, you’ll need to provide proof of income, tax returns, bank statements, identification, and information about your debts and assets. Our experts will guide you on the specific documents required for your application.

How long does the mortgage approval process take?

The mortgage approval process can vary based on several factors, including the type of loan and your financial situation. Generally, it can take anywhere from a few days to several weeks. We strive to make the process as quick and efficient as possible.

Thank you for choosing us. We are dedicated to helping you achieve your homeownership goals with personalized service and expert guidance. For more information or assistance, feel free to reach out to us anytime!

Facebook

Instagram

LinkedIn

TikTok